Key Takeaways

- Understanding the importance of payroll management for startups.

- Steps to set up a robust payroll system from scratch.

- Critical considerations for compliance and accuracy.

- Best practices for continuous payroll improvement.

Table of Contents

- The Importance Of Payroll Management In Startups

- Steps To Establish A Payroll System

- Essential Compliance And Legal Considerations

- Best Practices For Improving Payroll Processes

- Benefits Of Utilizing Payroll Software

Setting up a startup payroll involves key steps such as registering for tax IDs, choosing reliable payroll software, and defining employee classifications. Best practices include ensuring compliance with tax laws, automating payroll processes, and maintaining accurate records. These measures help streamline payroll management and ensure smooth business operations.

The Importance Of Payroll Management In Startups

Effective payroll management is a cornerstone for startups aiming for sustainability and growth. Correct and timely payroll promotes dependability and trust among employees, which may enhance job satisfaction and retention. Implementing a reliable startup payroll service can make a huge difference in managing financial overheads and handling all payroll-related tasks efficiently.

Moreover, a well-managed payroll system does more than issue paychecks. It plays a critical role in tax filings and compliance with federal and state regulations, which can minimize the risk of penalties and avoid any legal complications. Understanding distinct local requirements can be tricky but essential for startups operating in multiple states or regions. Effective payroll management helps prevent inconsistencies and mistakes that can cause financial loss and sour relations between employers and employees.

Steps To Establish A Payroll System

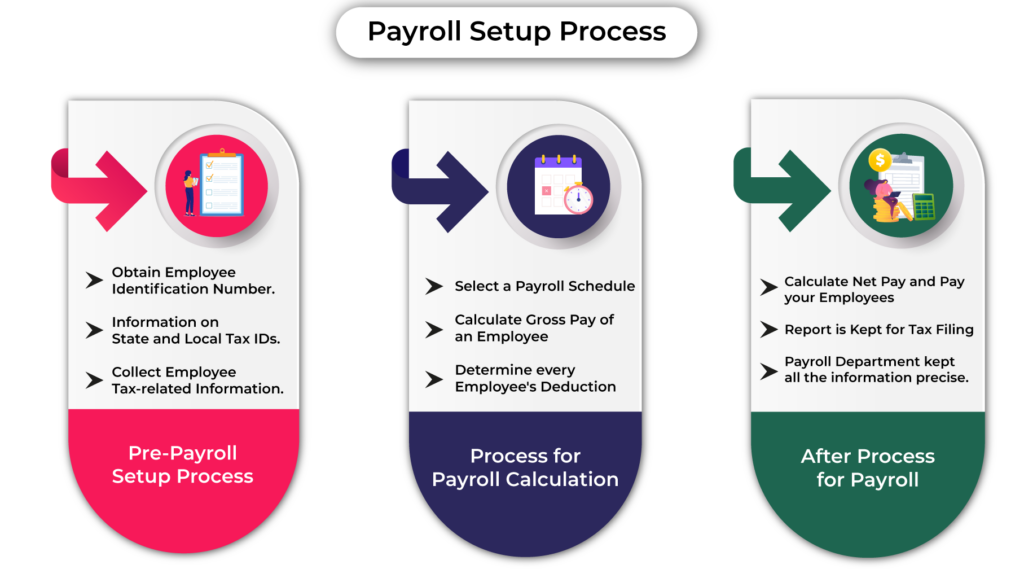

Although creating a payroll system from scratch can seem overwhelming, it can be simplified and less stressful by being broken down into simple parts.

- Get an Employer Identification Number (EIN) by Registering: Your EIN is crucial for reporting taxes and processing necessary documents. It’s a unique identifier similar to a Social Security number but for your business. You can request an EIN on the IRS website; these requests are usually filled out quickly and are free of charge.

- Classify Your Employees Correctly: Determining whether your workers are employees or independent contractors is vital. This classification affects how you withhold taxes and report earnings. Misclassification can lead to substantial legal and financial penalties. Employees typically require income tax, Social Security, and Medicare taxes to be withheld, while contractors handle their tax obligations.

- Choose A Payroll Schedule: Deciding how often to pay employees is another critical step. Standard payroll schedules include monthly, bi-weekly, or weekly pay periods. Consistency in your payroll schedule helps streamline the process and ensures employees can rely on regular paychecks, which is vital for morale and financial planning.

- Determine Employee Compensation: Calculate wages by considering hourly rates, salaries, bonuses, and benefits. It’s essential to define these clearly during the hiring process and to review compensation to ensure it remains competitive periodically. Fair and transparent compensation practices help in maintaining a satisfied and productive workforce.

- Set Up A Payroll System: Choose between hiring a service provider or utilizing payroll software. Both options have benefits. Payroll software can offer direct control and instant processing, while outsourcing might provide expert handling of complex payroll and tax requirements. Ensuring your system can handle computations, tax filings, and record-keeping is paramount.

Essential Compliance And Legal Considerations

Compliance is non-negotiable in payroll management. Startups must comply with state regulations and the Fair Labor Standards Act (FLSA) to avoid penalties. Maintaining accurate and detailed records for each employee and all payroll transactions is essential. Regularly auditing these records helps ensure compliance and accuracy, as well as readiness in case of inspection.

Startups must also stay updated on federal and state employment laws, which can change frequently. This includes regulations on minimum wage, overtime pay, and timely wage payments. Ignorance of the law is not a valid defense, so proactive measures to stay informed and compliant are necessary. For further guidance on compliance, consult resources on employment law compliance.

Best Practices For Improving Payroll Processes

Continual improvement in payroll processes can save startups time and reduce errors. Regularly reviewing the system for inefficiencies, conducting internal audits, and staying updated with industry best practices can substantially enhance payroll management. Training employees responsible for payroll processes ensures they are competent and confident in their roles.

Practical improvements include implementing automated systems or leveraging advanced payroll software, significantly reducing human error. Automation streamlines repetitive tasks, leaving more time for strategic decision-making and critical business operations. For a deeper dive into best practices, see this payroll processing guide.

Benefits Of Utilizing Payroll Software

Investing in payroll software can significantly enhance the efficiency and accuracy of your payroll system. Modern payroll solutions offer automation of tax calculations, employee record management, and direct deposits, thus streamlining the entire payroll process. The scalability of these tools makes them ideal for startups that anticipate growth, as they can adapt to increasing payroll complexities without any substantial overhauls.

Various software choices are available to accommodate varying needs and operational scales. These technologies provide features like compliance tracking, automated tax filing, and employee self-service portals that let workers view their payroll data independently. By minimizing manual data entry and administrative tasks, payroll software allows startups to focus on their core mission while ensuring payroll is handled efficiently and accurately.

In conclusion, a robust payroll system is critical for startups aiming for long-term success. By adhering to best practices, ensuring compliance, and leveraging the right tools and services, startups can manage payroll efficiently, fostering a positive and productive workplace. A startup payroll service can further streamline this essential function, freeing up valuable resources for business growth.